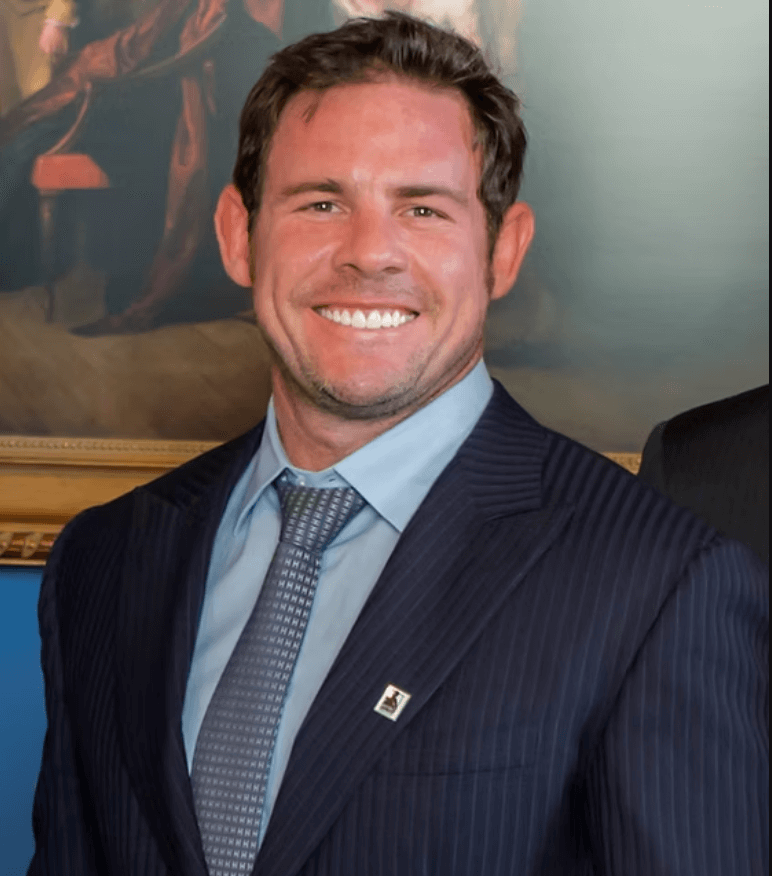

Luke Hillier Net Worth: Not Available (Private Individual)

Luke Hillier’s net worth remains undisclosed, reflecting his preference for financial privacy. This choice protects him from unwanted public scrutiny and potential risks such as identity theft. Understanding his reasons for maintaining confidentiality can shed light on broader themes of personal finance management. As financial transparency becomes more commonplace, the implications of privacy in wealth accumulation warrant further examination. What drives individuals like Hillier to guard their financial narratives so closely?

Understanding the Importance of Privacy in Personal Finances

Although financial success can often lead to public interest, maintaining privacy in personal finances remains crucial for individuals. Privacy concerns arise as individuals navigate the complexities of wealth, where exposure can attract unwanted scrutiny or exploitation.

Establishing financial boundaries protects one’s assets and personal life, allowing individuals to enjoy their success without external pressures. Additionally, safeguarding personal financial information minimizes risks such as identity theft or fraud, which can have devastating effects.

Individuals who prioritize financial privacy often implement strategies to manage their wealth discreetly, ensuring that their financial affairs do not become public fodder. Ultimately, valuing privacy empowers individuals to control their financial narratives, fostering a sense of security and autonomy in an increasingly interconnected world.

The Challenges of Researching Private Individuals

Researching private individuals presents a unique set of challenges, particularly in the context of wealth and financial status. The inherent research limitations stem from various factors:

- Limited Public Disclosure: Private individuals often do not disclose financial information publicly.

- Privacy Concerns: Many individuals actively protect their personal data from scrutiny, complicating research efforts.

- Lack of Reliable Sources: Information may be anecdotal or unverified, leading to inaccuracies.

- Legal Implications: Investigating personal finances can raise ethical and legal questions, particularly regarding data protection laws.

These obstacles necessitate a cautious approach, balancing the quest for information with respect for individual privacy.

Thus, researchers must navigate these complexities to obtain accurate insights into the financial status of private individuals.

Factors Influencing a Private Individual’s Net Worth

Various factors influence a private individual’s net worth, reflecting a complex interplay of personal, economic, and social elements.

Personal choices, such as spending habits, investment strategies, and saving patterns, significantly shape one’s financial landscape. Economic conditions, including market fluctuations and inflation rates, also play a crucial role, impacting asset values and income sources.

Additionally, factors like education level and career trajectory can determine earning potential, thereby affecting net worth. Social elements, such as familial wealth or community connections, may influence opportunities and access to resources.

For private individuals, maintaining financial privacy is essential, as it allows them to navigate these factors without the scrutiny that often accompanies public disclosure of net worth.

The Impact of Social Media on Financial Disclosure

Transparency has become a defining characteristic of the digital age, particularly in the realm of financial disclosure. Social media platforms have transformed how individuals and organizations share financial information, impacting public perception and trust.

Key aspects include:

- Instant Communication: Real-time updates on financial standings or investments.

- Wider Reach: Information can be disseminated to a global audience rapidly.

- User Engagement: Followers can interact, ask questions, and demand clarification.

- Reputation Management: Public scrutiny encourages individuals to disclose financial details to maintain credibility.

As a result, the influence of social media on financial disclosure has become significant, compelling individuals to navigate their privacy against the desire for transparency in an interconnected world.

Why Some Choose to Keep Their Finances Private

In an era where financial information is increasingly shared on social media, some individuals still opt for a more private approach to their finances. This choice often stems from a desire for financial anonymity and the establishment of personal boundaries. By maintaining privacy, they can protect themselves from potential scrutiny, unsolicited advice, and unwanted pressures.

| Reason for Privacy | Benefit | Example |

|---|---|---|

| Financial Anonymity | Reduces unwanted attention | Avoiding social media |

| Control Over Information | Personal empowerment | Limit sharing details |

| Protection from Judgment | Peace of mind | Discreet financial planning |

Ultimately, choosing to keep financial matters private allows individuals to navigate their economic lives with freedom and autonomy, free from external influences.

Also read The Science Behind Terraforming: Can We Really Make Mars Habitable?

The Role of Financial Literacy in Wealth Building

While many individuals aspire to build wealth, financial literacy serves as a crucial foundation for achieving this goal. Understanding financial concepts enables individuals to implement effective wealth strategies.

Key components of financial education include:

- Budgeting: Mastering income and expenses to allocate resources wisely.

- Investing: Learning about various asset classes to grow wealth over time.

- Debt Management: Understanding interest rates and repayment strategies to minimize liabilities.

- Retirement Planning: Preparing financially for the future to ensure a comfortable retirement.

Exploring Alternatives to Public Financial Transparency

How can individuals and organizations effectively manage financial information without the constraints of public disclosure?

Alternatives to public financial transparency include private financial management practices that prioritize personal autonomy. Utilizing private trusts, offshore accounts, and limited liability entities can provide individuals with the ability to control financial disclosure while maintaining confidentiality.

Emphasizing the importance of secure financial platforms and digital privacy protection ensures that sensitive information remains protected.

Additionally, adopting a minimalist approach to financial reporting can further safeguard personal and organizational assets.

Conclusion

In conclusion, the case of Luke Hillier exemplifies the broader trend of individuals opting for financial privacy amidst an increasingly transparent society. Just as a well-guarded vault secures treasures from prying eyes, maintaining discretion over one’s financial situation can shield against identity theft and undue scrutiny. This choice underscores the balance between personal security and the allure of public disclosure, highlighting the complexities of wealth management in a digital age where information flows freely yet can exact a heavy toll.